The municipal bond market has been a strong performer throughout 2017, but the market could see a turbulent end to the year. Next year, the market will see a number of important changes related to tax reform, a new Federal Reserve Chairman, and Puerto Rico’s long road to recovery.

Investors may want to take note of these trends to adjust their portfolios since it directly impacts their risk-adjusted returns and liquidity.

How Did Munis Fare in 2017?

Municipal bonds fared well throughout most of 2017 as a tax-advantaged fixed-income asset class in a strong bull market. The S&P Municipal Bond Index has returned 4.45% and yields fell from above 3.3% to a low of just under 2.9%, as of December 5, 2017. However, these trends have sharply reversed in November, with yields moving back above 3.1% and prices falling to levels last seen in June of this year.

The tax bills passed by the House and Senate led to the increase in yield to maturity in November. The proposed tax reform would reduce or eliminate the tax advantages of certain types of municipal bonds, which caused many issuers to push their schedules forward and issue new bonds before the end of the year. The increase in muni bond supply may continue to push prices lower and yields higher through the end of December.

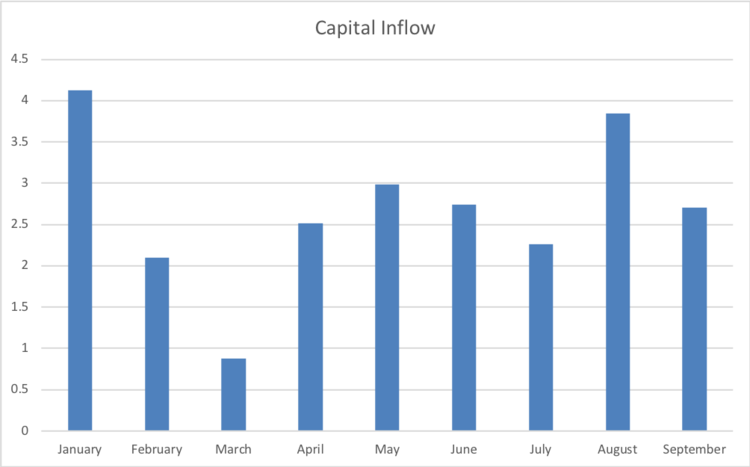

The good news is that there seems to be strong demand for muni bonds across the board, as can be seen below. Over the past year, muni bond inflows have ranged from just under $1 billion to more than $4 billion per month without a single month of capital outflows. Lofty equity valuations could be leading to a move into muni bonds as a way to hedge against the risk.

It is worth noting that some of the best-performing muni bond sectors were infrastructure (for example, this Build America Bond issued by Massachusetts), tobacco, and health care.

See Recent Muni Bond Trades to find more municipal bonds that are drawing buyers and sellers.

Three Trends to Watch in 2018

The municipal bond market could see several big changes moving into 2018.

Before moving on, you might want to check out the due diligence process required for muni bonds before you make an investment decision.

1. Implications of the Tax Reform Policy

Tax reform could have the biggest impact on the muni bond market next year. The proposed legislation would make general obligation bonds more attractive for tax reduction purposes while limiting new issuances to borrowings from states and local governments. This could translate to less supply of higher-yield revenue bonds and more demand for specialty state general obligation bonds moving into next year.

At the same time, the tax reforms will eliminate several tax deductions for wealthy individuals, including property and sales tax deductions, while keeping the top tax rate steady. This could make muni bonds more attractive to high-net-worth investors and stimulate demand. The corporate tax rate is expected to move from 35% to 20%, however, which could limit corporate demand for muni bonds across the board.

2. Impact of Monetary Policies Adopted by Jerome Powell

President Trump has appointed Jerome H. Powell as the next Chairman of the Federal Reserve to replace Janet Yellen. A Chairman that favors low interest rates could reduce the pace of rate hikes and ultimately help support bond prices compared to someone who would have accelerated rate hikes and hurt bond prices.

Powell is largely considered a non-interventionist and favors traditional monetary policy measures and a free market approach. He has always voted alongside Janet Yellen on policy decisions in the past and speeches suggest that he favors a cautious approach, but some experts believe he could be a little less dovish than Yellen. So the market will closely be watching where he falls on the spectrum.

3. Learnings from the Puerto Rico Fiasco

Puerto Rico will continue on the long road to recovery next year after being hit by two hurricanes in September 2017. With a $36.5 billion relief bill from Washington, the commonwealth accessed a $4.9 billion liquidity facility financed under the Community Development Loan Program to help offset the loss of tax revenue. These efforts could help increase funding to pay off muni debt obligations moving into early 2018.

The Puerto Rico Oversight Board continues to work on a restructuring of the island’s debt with the goal of certifying a revised fiscal plan by February 2018. Among other things, the board must decide whether general obligation creditors that have first lien on all general revenue or COFINA creditors that have priority over sales tax receipts should be paid first. The impact of the hurricanes and resulting shifting of budget allocations has further complicated the issues.

The Bottom Line

The municipal bond market has been a strong performer throughout most of 2017, but there are three big trends to watch moving into the new year, including tax reforms, changes to monetary policy set by the incoming Chairman of the Federal Reserve, and Puerto Rico’s restructuring plans. By keeping an eye on these developments, muni bond holders can adjust their portfolios to limit risk and improve their long-term risk-adjusted returns.

Check out the different ways to invest in muni bonds and stay current with the latest investment strategies.

Or become a Premium member to get immediate access to all the latest Moody’s credit reports for municipal bonds across the U.S. and enhance your analysis for a specific security.