Many state and local governments have been struggling with public pension obligations that could jeopardize their ability to repay debt in the future. While the majority of governments have ample wriggle room at the moment, there are several governments at risk of near-term problems stemming from these rising costs. Muni bondholders should be aware of these issues when screening for opportunities and making investments.

In this article, we’ll take a closer look at how pension obligations are affecting the muni bond market and some considerations for investors.

Crisis Brewing in Pensions

Several state and local governments offer pensions that provide a lifetime stream of retirement income to employees. Of course, governments (and employees) must contribute and invest in funds in order to pay these pensions in the future. The idea is that contributions made during employment years will be sufficient to cover the employees’ pension payments throughout their retirement years and, thus, be an incentive for employees to take government jobs.

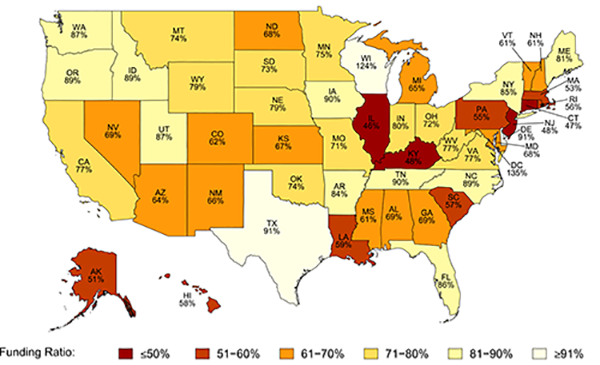

Pension Liabilities Funding Ratio

Two problems have arisen with these pension obligations:

- Many pension programs were implemented at a time when experts assumed that stocks would average 7-8% per year and fixed income investments would provide 3-4%. Since then, fixed income yields have plunged, and many economists argue that modest 5% annual returns for stocks may be the new norm. This means that pension obligations have become more expensive to maintain, as a greater number of employees retire.

- Several governments have underfunded their pension obligations after experiencing tighter budgets following the 2008 financial crisis. According to S&P data, the average fiscal year 2013 funded ratio for all states (excluding Puerto Rico) was 71.2%, with states like Illinois having just 39.3% of their pension obligations funded. These states could prioritize paying pensions over bondholders and introduce default risk.

The good news is that pension contributions currently amount to just 7% of total taxes, according to the Nelson A. Rockefeller Institute of Government, which means that most governments will be able to meet their current pension obligations. The bad news is that several muni bond issues could be at risk – such as the City of Chicago’s bonds, for which pension obligations account for a lofty 37% of the city’s operating revenues.

Impact on Muni Investors

The short-term impact of pension obligations on the municipal bond market will likely be isolated to state and local governments experiencing acute issues. For example, Chicago’s bonds were cut to just above ‘junk’ status, after the Illinois Supreme Court rejected the city’s plans to deal with its pension obligations. These credit rating downgrades have an adverse effect on bond prices and could result in defaults like those in Stockton, CA and Detroit, MI.

Over the long term, the impact of pension obligations is less certain, because there’s more time for governments to effectively address the issue. More than 2,000 bills have been introduced relating to pension reform over the past year or so, which could address many of these problems before they become a larger risk factor to the $3.7 trillion market. Reducing employee benefits can be difficult, but it’s a process that has been accomplished in the past.

Muni bond investors should familiarize themselves with the pension obligations associated with the bonds in which they’re investing. Often times, this data can be found in issuer-provided offering documents or other updates, although these disclosures may be delayed. Another option is leveraging professional credit monitoring services or relying on ratings agencies that tend to be more up-to-speed than retailer investors on a bond’s potential risks.

The Bottom Line

Pension obligations have become a major problem for the $3.7 trillion municipal bond market, with issuers like the City of Chicago being downgraded to just a notch above ‘junk.’ While these issues have yet to be resolved, the high number of pension reforms in the legal process throughout the country represents hope for a peaceful resolution. Investors should carefully conduct their own due diligence, however, before investing in any muni bonds.